16a Did you make any payments in 2018 that would require you to file Form s 1099 See instructions. Persons With Respect to Certain Foreign Partnerships attached to this return. Enter the number of Forms 8865 Return of U.S. See Information Statement of Section 1446 Withholding Tax filed for this partnership. Disregarded Entities FDEs and Foreign Branches FBs enter the number of Forms 8858 attached. Undivided interest in partnership property.

b Did any individual or estate own directly or indirectly an interest of 50 or more in the profit loss or capital of the partnership For rules of constructive ownership see instructions. If Yes attach Schedule B-1 Information on Partners Owning 50 or More of the Partnership. 11390Z Form 1065 2018 Schedule B a e Page Other Information What type of entity is filing this return Check the applicable box Domestic general partnership Domestic limited partnership d Foreign partnership f Other At the end of the tax year Did any foreign or domestic corporation partnership including any entity treated as a partnership trust or taxexempt organization or any foreign government own directly or indirectly an interest of 50 or more in the profit loss or capital of the partnership For rules of constructive ownership see instructions. May the IRS discuss this return with the preparer shown below See Yes No Date PTIN Firm s EIN Firm s address For Paperwork Reduction Act Notice see separate instructions. If Yes the partnership is not required to complete Schedules L M-1 and M-2 item F on page 1 of Form 1065 or item L on Schedule K-1. i Name of Entity ii Employer Identification iii Type of Entity Organization v Maximum Percentage Owned in Profit Loss or Capital Does the partnership satisfy all four of the following conditions c Schedules K-1 are filed with the return and furnished to the partners on or before the due date including extensions for the partnership return.

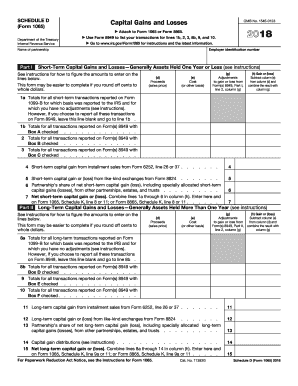

9b Unrecaptured section 1250 gain attach statement. Net long-term capital gain loss attach Schedule D Form 1065. Net short-term capital gain loss attach Schedule D Form 1065. 6a 6b b Qualified dividends c Dividend equivalents 6c Royalties.

0 kommentar(er)

0 kommentar(er)